Your Ultimate Guide to Business Tax Deductions

Why Tax Deductions Matter for Your Business

So many small business owners over pay in taxes each year. In fact, the average small business misses out on about $1,200 a year in business tax deductions. Whether you work alone or run a growing LLC, knowing which expenses you can deduct helps you keep more of your money. In this guide, you’ll learn:

- The most overlooked deductions (yes, your home office can count!)

- How tax credits differ from deductions

- Smart ways to maximize your savings without breaking IRS rules

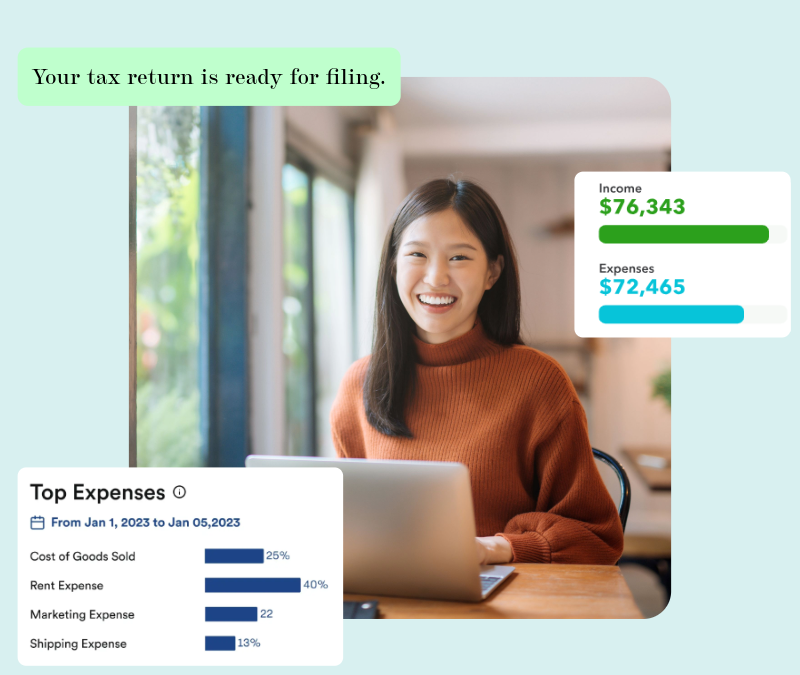

📈 Ready to to file your tax return? Let a Gnesist Professional File Your tax Return!

Part 1: The Top Underused Business Tax Deductions

1. Home Office Deduction

- Who Qualifies: You must use part of your home regularly and exclusively for business.

- Simplified Method: Deduct $5 per square foot, up to 300 square feet (max $1,500).

- Actual Expenses Method: Deduct a percentage of mortgage interest, utilities, and repairs.

- Example: If your home office is 200 sq ft out of 2,000 sq ft, that’s 10%. If annual utilities cost $3,000, you can deduct $300.

Pro Tip: Take pictures of your workspace and keep a simple floor plan on file.

2. Vehicle Expenses

- Option 1: Standard mileage rate is 67¢ per mile in 2024.

- Option 2: Actual costs (gas, insurance, repairs, lease payments).

- Case Study: A consultant who drives 15,000 business miles a year could save $10,050 (15,000 x 0.67).

- Audit-Proof Strategy: Use a mileage tracker (e.g., Everlance) and note the purpose of each trip.

3. Employee Salaries & Benefits

- Wages, bonuses, and commissions

- Health insurance premiums (including dental/vision)

- Retirement contributions (401(k), SEP IRA)

- Education costs for work-related courses

- Key Rule: S-Corp owners must pay themselves a “reasonable salary” before taking extra profits.

4. Software & Subscriptions

- Accounting tools (QuickBooks, Xero)

- CRMs (HubSpot, Salesforce)

- Industry apps (Canva, AutoCAD)

- Cloud storage (Dropbox, Google Workspace)

- Niche Deduction: Cybersecurity software (firewalls, antivirus).

5. Marketing & Advertising

- Social media ads (Facebook, LinkedIn)

- Website hosting and maintenance

- Print materials like business cards and brochures

- SEO tools (Ahrefs, SEMrush)

- Warning: Political or lobbying costs are not deductible.

6. Travel & Meals

- Domestic Travel: Flights, hotels, rental cars are 100% deductible if they’re for business.

- Meals: 50% deductible with clients or employees (keep receipts and note who was there).

- International Travel: Deduct if you spend over half the trip on business.

- Example: A 5-day trade show in Germany with 3 business days (and 2 personal days) would be 60% deductible.

7. Professional Services

- Lawyers, accountants, and consultants

- Bookkeeping and tax preparation

- Business coaching or mentoring

- Pro Tip: You can deduct fees for tax help if you get audited.

8. Office Supplies & Equipment

- Computers, printers, and furniture

- Everyday supplies like pens and postage

- Section 179 Deduction: You can write off up to $1.16 million of equipment in the first year.

- Example: A bakery can deduct a $15,000 oven right away, instead of spreading it out over time.

9. Insurance Premiums

- Liability insurance

- Workers’ compensation

- Business interruption insurance

- Malpractice insurance (for certain professionals)

- Special Case: Self-employed people can deduct their health insurance premiums on Schedule 1, Line 17.

10. Education & Training

- Rule: Courses must improve or maintain the skills you use in your current business.

- Workshops, conferences, and certifications

- Trade journals

- Online courses (Coursera, Udemy)

Part 2: Business Tax Deductions vs. Credits : Double Your Savings

What’s the Difference?

| Business Tax Deductions | Business Tax Credits | |

|---|---|---|

| Effect | Reduce taxable income | Directly lower your total tax bill |

| Example | $10k deduction could save $2,200 in a 22% tax bracket | $10k credit saves $10k outright |

Top 5 Credits for 2024

- Employee Retention Credit (ERC): Up to $26k per employee (retroactive for 2020–2021).

- Eligibility: If your revenue dropped or you had a government closure.

- Work Opportunity Tax Credit: Up to $9,600 per new hire in certain groups (veterans, ex-felons, SNAP recipients).

- R&D Tax Credit: 20% of qualified research costs (common in tech or manufacturing).

- Clean Energy Credits: 30% back on solar panels, EV charging stations, or energy upgrades.

- Paid Family Leave Credit: 25% of wages paid during employee leave.

- Case Study: A manufacturing firm claimed $48k via the R&D credit for developing a new product line.

Part 3: How to Maximize Your Business Tax Deductions Without Triggering an Audit

- Track Expenses Daily

- Use QuickBooks or a similar tool to auto-categorize spending.

- Snap and store receipts with Shoeboxed or Expensify.

- Master Section 179 & Bonus Depreciation

- Section 179: Deduct equipment right away (limit $1.16M in 2024).

- Bonus Depreciation: Write off 80% of asset costs in the first year (drops to 60% in 2025).

- Example: A trucking company that buys a $150k semi-truck can:

- Deduct $150k immediately with Section 179, or

- Deduct 80% ( $120k ) with Bonus Depreciation.

- Choose a Tax-Friendly Business Structure

- S-Corp: Can save on self-employment taxes by splitting owner pay between salary and distributions.

- LLC: Gives flexibility in deductions without double taxation.

- Keep Audit-Proof Records

- Save records for 3–7 years (longer if claiming bad debt).

- Use digital logs to track mileage, home office hours, and client meetings.

- Use Retirement Contributions

- SEP IRA: Contribute up to 25% of net earnings ($66k max in 2024).

- Solo 401(k): $23k employee limit plus 25% employer contributions.

- Pro Tip: These contributions lower taxable income and grow tax-deferred.

Part 4: 7 Common Deduction Mistakes (And How to Avoid Them)

- Mixing Personal and Business Funds

- Fix: Keep separate bank accounts and label expenses clearly.

- Overclaiming Home Office Space

- Fix: Measure your workspace and don’t include personal areas.

- Missing Deadlines

- Fix: Mark key IRS due dates: April 15, June 17, Sept 16, Jan 15 (2025).

- Misclassifying Employees as Contractors

- Fix: Use the IRS 20-Factor Test to decide worker status.

- Ignoring State-Specific Credits

- Fix: Look for programs like California’s Competes Tax Credit.

- Not Documenting Charitable Gifts

- Fix: Keep receipts and get letters for donations over $250.

- Forgetting Carryforwards

- Fix: Track unused credits (like R&D) to use them in later years.

- Red Flag: Don’t deduct 100% of a vehicle if you also use it for personal errands.

FAQs: Your Top Questions on Business Tax Deductions

Q1: “Can I deduct my gym membership if I network there?”

A: No. You can only deduct a club membership if it’s strictly for business (like a golf club used for client meetings).

Q2: “Are business gifts deductible?”

A: Yes. You can deduct up to $25 per recipient per year (for example, branded calendars).

Q3: “Can I deduct unpaid invoices?”

A: Only if you already reported that income as taxable. It’s called a “bad debt deduction.”

Q4: “Is my LLC’s state filing fee deductible?”

A: Yes. It’s considered an organizational cost, usually spread out (amortized) over 15 years.

Q5: “What if I work from a coffee shop?”

A: You can’t write off your coffee, but internet fees used for work might be 50% deductible.

Conclusion: Make Tax Savings Work for You

Mastering business tax deductions does more than keep you on the right side of the IRS. It frees up cash to:

- Invest in hiring and marketing

- Build a cushion for tough economic times

- Outperform the competition by using every dollar wisely

Next Steps: Let Us File Your tax Return!

“Thanks to proper deductions, we saved $27k last year—money we poured into new equipment.”

– Sarah J., Construction Company Owner