Understanding Cost of Goods Sold (COGS): How We Calculate It for Your Business

5 min read

At Gnesist, we know that managing your finances is crucial to the success of your business. One key aspect that can significantly affect your profitability is the Cost of Goods Sold (COGS). For our clients who deal with inventory, it’s important to understand how we calculate COGS and why it matters for your financial reporting.

In this blog, we’ll break down the basics of COGS and explain how it’s calculated when you sell inventory items.

What Is Cost of Goods Sold (COGS)? #

Cost of Goods Sold refers to the direct costs associated with producing or purchasing the products that your business sells. This includes the cost of materials, labor, and overhead directly tied to the production or acquisition of those products. COGS is a crucial figure in determining your business’s gross profit because it directly impacts how much of your revenue turns into profit.

To put it simply, COGS is calculated when an inventory item is sold—not when it’s purchased or produced. This is an important distinction to make because it directly affects how you report your expenses and profits.

Recording Inventory Purchases to GL Code 1400 #

We ensure that all purchases related to the production or acquisition of your inventory are properly recorded under General Ledger (GL) Code 1400 – Inventory. This includes not only the cost of the raw materials or products you purchase, but also any direct costs incurred in getting those items ready for sale.

Here’s a list of common purchases that might be included in Cost of Goods Sold (COGS):

- Raw materials – The direct materials used in the production of goods.

- Direct labor – Wages paid to employees who manufacture or produce goods.

- Manufacturing supplies – Items needed for production but not part of the final product (e.g., tools, gloves).

- Packaging and labeling costs – Costs to package and label finished products.

- Freight-in/shipping costs – The cost of transporting raw materials or finished goods to your business.

- Factory overhead – Indirect costs like utilities, rent, or depreciation on equipment used in production.

- Customs duties and taxes – Fees paid for importing materials or products.

- Repair and maintenance of production equipment – Costs for maintaining or repairing machinery used in production.

- Storage costs – Expenses related to warehousing raw materials or inventory awaiting sale (if directly tied to production).

- Quality control and inspection costs – Costs associated with testing or inspecting goods to ensure quality.

By recording these purchases in GL Code 1400, we ensure that your inventory reflects the full cost of production, providing you with accurate financial data when inventory items are sold.

How COGS Is Calculated #

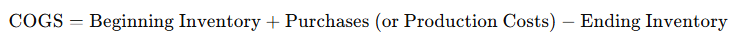

The formula for calculating COGS is straightforward:

This formula tells you how much it cost to produce or acquire the items you sold during a specific period. Let’s break down each element of the formula:

- Beginning Inventory: The value of the inventory you had on hand at the start of the period.

- Purchases (or Production Costs): The cost of additional inventory you acquired or produced during the period.

- Ending Inventory: The value of the inventory you still have on hand at the end of the period.

The result is the cost of the goods that were sold, not just purchased.

Why COGS Is Calculated When Inventory Is Sold #

It’s crucial to understand that COGS is only recognized when an item is sold, not when you initially purchase or produce the inventory. This approach aligns your costs with your revenue, giving you a more accurate reflection of your profit margins. Here’s why this matters:

- Matching Principle: According to accounting standards, expenses should be matched with the revenue they generate. By calculating COGS when an item is sold, we align the cost of that item with the revenue from its sale in the same accounting period. This provides a clearer picture of your business’s profitability.

- Accurate Financial Reporting: Recognizing COGS only when an inventory item is sold helps to avoid misleading financial statements. If you recorded inventory costs when purchased, your expenses could appear inflated in periods when no sales occur, distorting your true profitability.

Example: Let’s say your business buys 100 units of a product for $5,000 in January. You don’t sell any of these items until March. Under proper accounting practices, COGS is not recognized in January, but in March—when you sell those units. If you sell 50 units in March, the cost of those 50 units is recognized as COGS for that month. The remaining 50 units stay in your inventory and are not expensed until sold.

How COGS Affects Your Business #

COGS directly impacts your gross profit, which is calculated as:Gross Profit=Revenue−COGS\text{Gross Profit} = \text{Revenue} – \text{COGS}Gross Profit=Revenue−COGS

A higher COGS will reduce your gross profit, while a lower COGS will increase it. Accurately calculating COGS is essential for determining the true profitability of your business. If COGS is underestimated, your profits will appear higher than they are, which could lead to financial mismanagement. Overestimating COGS, on the other hand, could lead to underreporting your profits and paying less attention to cost-control measures.

Key Considerations for COGS #

- Inventory Accounting Methods: The method you use to track inventory (FIFO, LIFO, or Weighted Average) affects how COGS is calculated. For example, under FIFO (First In, First Out), the oldest inventory costs are recognized first, while LIFO (Last In, First Out) assumes the newest inventory is sold first. Each method can lead to different COGS figures, especially in times of fluctuating prices.

- Inventory Valuation: It’s important to regularly assess the value of your inventory to ensure your financial statements are accurate. Obsolete or unsellable inventory should be written down, as carrying such inventory can distort your COGS and overall financial health.

- Tax Implications: Since COGS directly reduces your taxable income, accurately calculating and reporting COGS is important for tax purposes. Understating COGS may result in overpaying taxes, while overstating it could lead to underpayment and potential issues with tax authorities.

Why COGS Matters to Your Business #

Accurate calculation of COGS is more than just a compliance requirement—it’s a crucial metric for understanding your business’s performance. It helps you:

- Monitor Profitability: By tracking COGS, you can gauge whether your cost of production or purchasing is sustainable relative to your sales revenue. This insight is key to managing margins and ensuring long-term profitability.

- Control Costs: COGS provides insight into where you may be able to reduce costs, whether through more efficient production, better purchasing strategies, or negotiating with suppliers.

- Make Informed Pricing Decisions: Understanding your COGS allows you to set prices that cover your costs and generate a desired profit margin. Without this, you risk underpricing or overpricing your products.

Conclusion: How Gnesist Can Help #

At Gnesist, we specialize in helping businesses like yours manage their financials, including the accurate calculation of COGS. We ensure that your COGS is calculated only when inventory is sold, giving you an accurate view of your financial health.

If you have questions about your COGS or want to make sure you’re using the right accounting methods for your inventory, reach out to us today. We’re here to help you stay on top of your costs and maximize your profitability.

Powered by BetterDocs